Features

Trade with

Lowest Slippage

Monadium's smart routing and latest AMM technology with concentrated liquidity are optimized to provide low slippage and generate maximum fees facilitating a smooth trading experience.

Inspired by

ve(3,3) Model

Inspired by the vote-escrow model from Curve, veMNDM holders control Monadium's emissions. Model rewards long-tem supporters, and reward participants that enable the sustainable growth of the protocol.

Trade your favourite

Memes

Monadium serves as a central hub for your favourite memecoins. Create a pool and start mooning.

Dynamic Liquidity Flywheel

Monadium's self-optimizing liquidity model seamlessly integrates advanced technology with strategic insights, continuously enhancing capital efficiency within its ecosystem. This ongoing refinement fosters a balanced and optimized environment.

how it works

Control Monadium’s destiny by locking into veMNDM

Setp 1

Lock MNDM token

and Receive veMNDM

Lock MNDM to receive vote-escrowed MNDM (veMNDM). The longer the lock, the more veMNDM you receive.

Setp 2

Use veMNDM to Vote

for Your Favorite Pools

veMNDM gives you the power to decide which pools should receive MNDM emissions.

Setp 3

Receive Bribes

and Trading Fees

Voting for a pool lets you claim a share of the weekly bribes and trading fees.

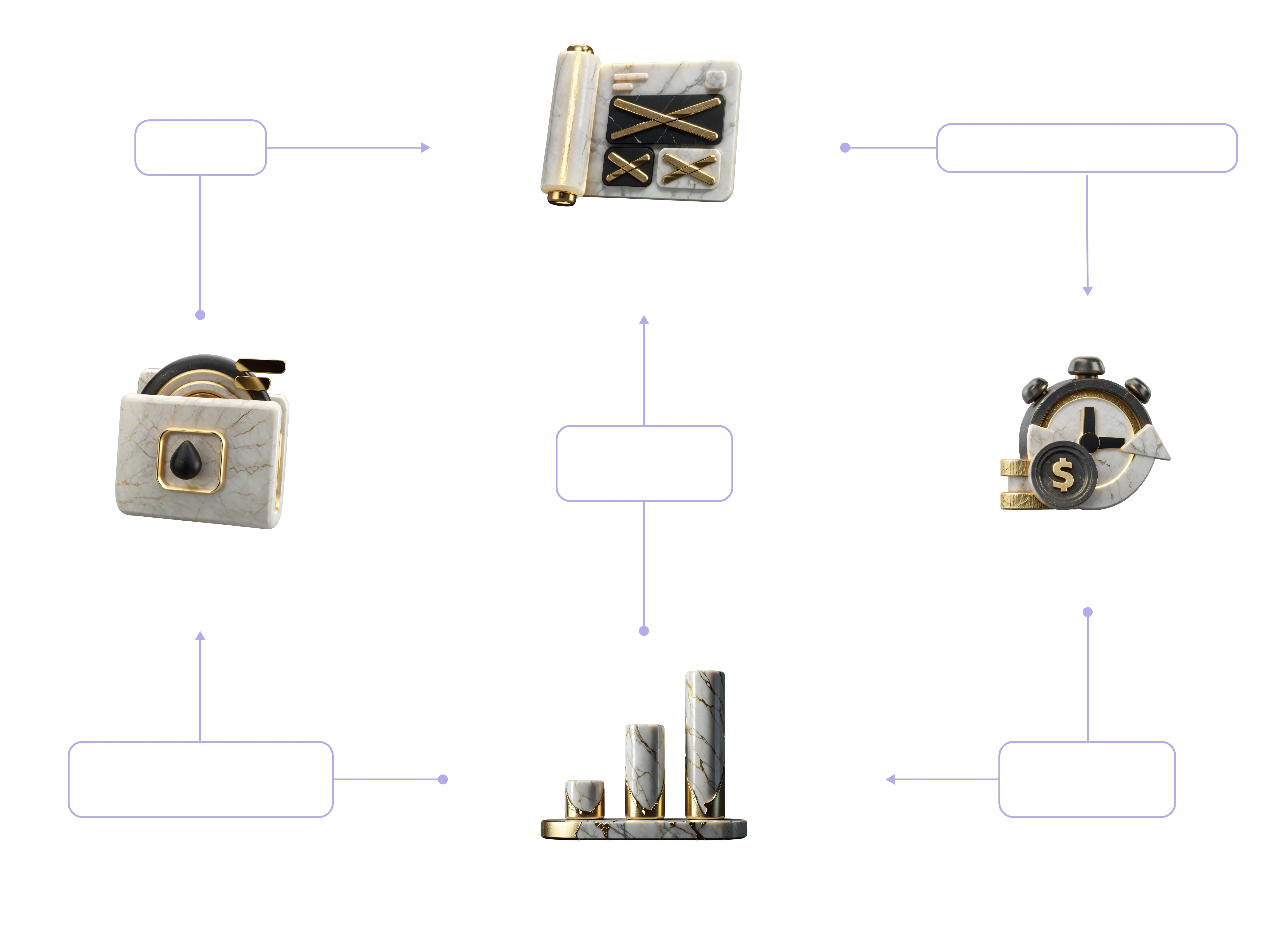

Setp 1

Request Gauge

Whitelisting

Protocols that seek to open a gauge, have to request a whitelisting by presenting a proposal.

Setp 2

Create a Bribe With

Few Clicks

Once the gauge has been initiated, anyone can bribe it with just a few clicks. Bribes are set per epoch, which lasts for 7 days.

Setp 3

Receive Emissions

From veMNDM Holders Votes

MNDM emissions are distributed to the gauges for new epoch based on votes from veMNDM holders.